The Opening An Offshore Bank Account PDFs

Table of ContentsTop Guidelines Of Opening An Offshore Bank AccountUnknown Facts About Opening An Offshore Bank AccountThe Only Guide for Opening An Offshore Bank AccountIndicators on Opening An Offshore Bank Account You Should KnowNot known Details About Opening An Offshore Bank Account Indicators on Opening An Offshore Bank Account You Should Know

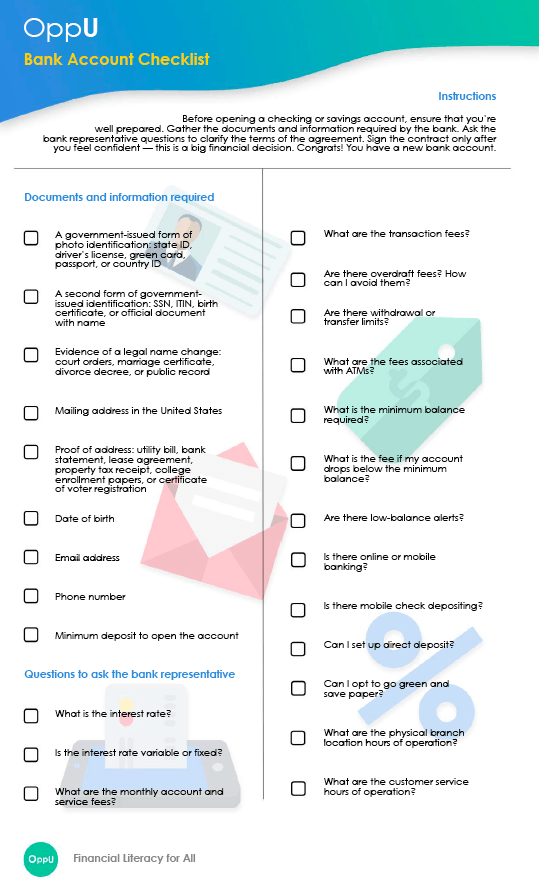

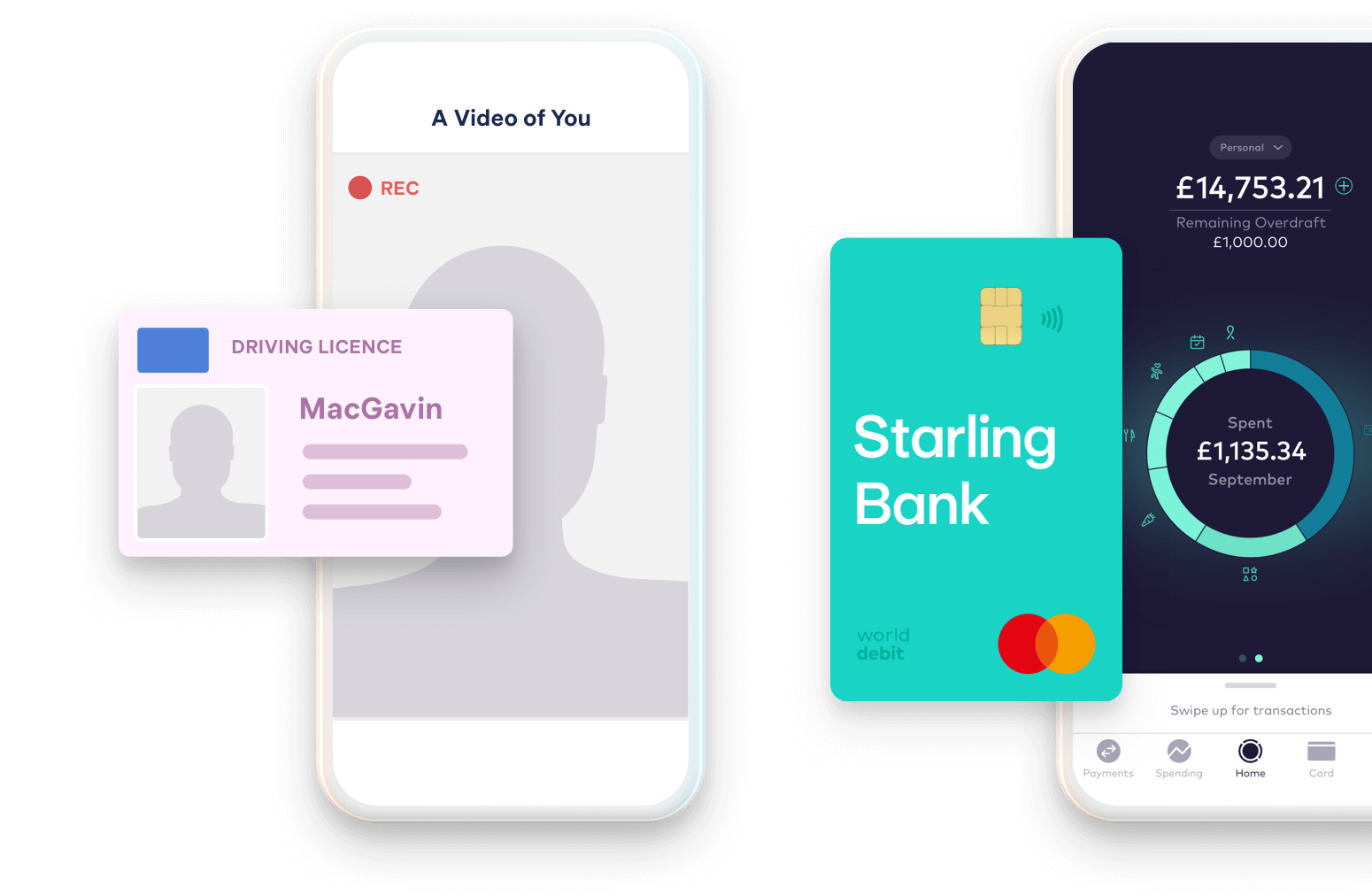

Whether you're believing of transferring to the UK or you have actually arrived there currently, at some time you're mosting likely to need a savings account. In the past, opening a financial institution account in the UK was extremely challenging if you were brand-new to the country. Luckily, nowadays, it's become somewhat simpler (opening an offshore bank account).When you have actually changed your address, ask your bank to send out a financial institution declaration to your new address by article, and also you'll have a file that verifies your UK address. If you do not have a proof of address in the UK and you need to open an account, Wise's multi-currency account may be the ideal selection for you.

Can I open a bank account before I show up in the UK? Yes, you can. Your residence financial institution may be able to set up a represent you if it has a contributor banking relationship with a British bank - opening an offshore bank account. Numerous significant UK banks also have supposed. These are made especially for non-residents, so they're a fantastic choice if you don't have the records to confirm your UK address.

What Does Opening An Offshore Bank Account Mean?

You might not be able to close the account and button to a much better bargain till a collection period of time ends. The Wise multi-currency account.

Some banks are rigorous with their requirements, so opening a savings account with them will be challenging. What is the most convenient bank account to open in the UK? It's usually easier to open an account with among the - Barclays, Lloyds, HSBC or Nat, West. These financial institutions have stayed in business for a long period of time as well as are very secure.

Get This Report on Opening An Offshore Bank Account

Nonetheless, the are Barclays, Lloyds, HSBC as well as Nat, West. Allow's have an appearance at what each of them have to supply. Barclays Barclays is just one of the earliest banks in the UK; and also has greater than 1500 branches around the nation. It's also possibly one of the easiest financial institutions to open up an account with if you're brand-new to the UK.

The account is cost-free as well as features a contactless visa debit card as standard. Nonetheless, you won't be able to use your account instantly. When you remain in the UK, see it here you'll have to visit a branch with your recommendation number, key and proof of address in order to turn on the account.

Barclays likewise provides a couple of various organization accounts, relying on the annual turn over price. You can obtain in touch with customer support by means of a online chat, where you can go over the information of your application as well as ask concerns in genuine time. Lloyds Lloyds is the largest supplier of current accounts in the UK, as well as has about 1100 branches throughout the nation.

5 Simple Techniques For Opening An Offshore Bank Account

You can get in touch with customer assistance via a online conversation, where you can talk about the information of your application and ask any type of inquiries in actual time. Various other financial institutions worth looking into While Barclays, Lloyds, HSBC and also Nat, West are the 4 largest banks in the UK, there are likewise various other banks you can check.

Of course, it's constantly best to look at what various banks have to use and see who has the best deal. You can obtain a basic current account at no regular monthly price from many high street banks.

A lot of banks likewise have superior accounts that supply fringe benefits such as cashback on house bills, in-credit rate of interest as well as insurance coverage. These accounts will certainly often have regular monthly fees and minimal eligibility demands; and also you might not qualify if you're brand-new to the UK. You'll additionally require to be cautious to remain in debt.

Indicators on Opening An Offshore Bank Account You Should Know

If you're not utilizing one of your financial institution's ATMs, check the maker. Several banks will charge you could try this out a, which can be as high as 2.

When you open this account, you'll have the option to secure an. A prepared over-limit permits you to obtain cash (as much as an agreed limitation) if there's no money left in your account. This can be beneficial if you're struck with an unforeseen costs. If a settlement would certainly take you past your prepared limit (or if you do not have one), we might allow you obtain utilizing an.

6 Simple Techniques For Opening An Offshore Bank Account

We'll always attempt to allow crucial payments if we can - opening an offshore bank account. You can get a set up overdraft account when you open your account, or at any moment later on. You can ask to enhance, get rid of or decrease your limitation any time in online or mobile financial, by phone or in-branch.

We report account activity, including over-limit usage, to credit score reference firms. An unarranged over-limit lasting even more than 1 month might have a negative influence on your credit report score. This account comes with go a. If you go overdrawn by more than that, you'll need to pay passion on the quantity you borrow at the rate shown.